AMAZON No.1 BEST SELLING AUTHOR NICHOLE LEWIS

Property Quadrants

"The author gives quite a bit of information in this book without making it overwhelming. I am so glad I came across this book though because it ended up being exactly what I was looking for without even realizing it! I have already given this book to my husband to read as well, so that we can use this book to start taking action in the real estate investment world. If you are considering something like this, I would say this book is a must read."

CELESTE L - AMAZON REVIEW

CRASH COURSE LAUNCHED!!

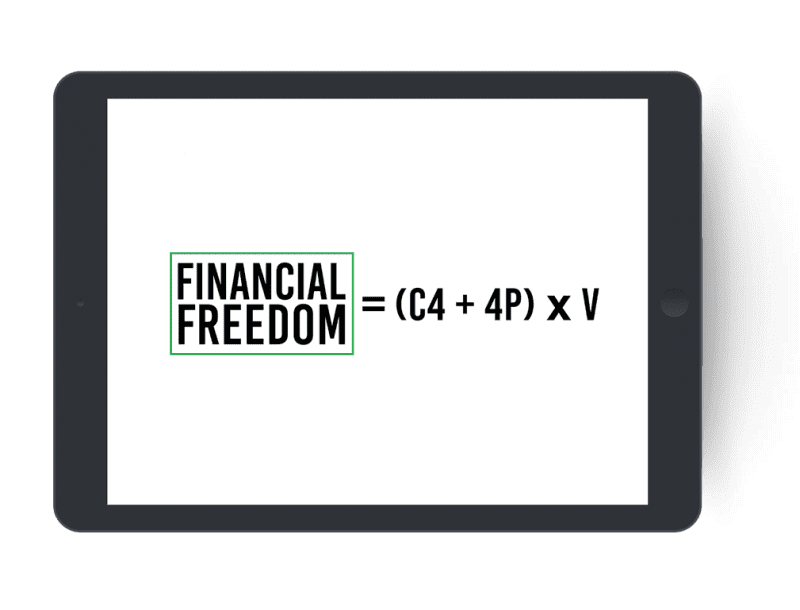

Get the personal video training done by Nichole on how this magic four quadrant formula can change your financial future.

What's Inside Property Quadrants!?

- Secret #1: Making My First Million For The Second Time - Mistakes I Made And 9 Key Principles (Page 1)

- Secret #2: Property Lifestyle Action Steps (Page 15)

- Secret #3: Property Quadrants Overview - Understanding The Four Quadrants (Page 24)

- Secret #4: Quadrant One - Your Family Home (Page 27)

- Secret #5: Quadrant Two - Cash Poor Property - 5 Common Mistakes (Page 37)

- Secret #6: Quadrant Three - Cash Rich Property - Crucial Rules and Key Lessons for Successful Projects (Page 47)

-

Secret #7: No Money Deals - Make Money Without Having Any Money - Five Types of No Money Deals (Page 63)

- Secret #8: My Flipping Formula - The Seven Steps (Page 79)

- Secret #9: DIY or Not? - Examples and numbers - Why It's Better To Leave It To The Experts (Page 89)

- Secret #10: Quadrant Four - Passive Income Formula - Four Actionable Steps To Get Predictable Results (Page 105)

- Secret #11: Quadrant Four - Passive Portfolio Lifestyle - The Numbers (Page 115)

- Secret #12: The Invitation - Where Do I Go From Here? (Page 123)

"I love her introduction. It is so personal and real. Giving life lessons of how to avoid the 7 biggest mistakes in real estate investing is gold! I would love to meet the author someday and compare notes of comeback stories."

Paul T. Neustrom- NeuStream Media

#1 INTERNATIONAL BEST SELLING BOOK IN INVESTING BASICS

PROPERTY QUADRANTS™

The Passive Income Formula

From The Queen of Property - Nichole Lewis

Property Quadrants is a concept I was inspired to create in relation to property investing after reading Robert Kiyosaki's book explaining his cash flow quadrants. Property Quadrants examines the four ways that real estate investing works and takes the reader through real life stories of how I have helped people turn their lives around using the formulas outlined in the quadrants. The real life examples also list all the numbers on passive income portfolios and explain how to get there.

My inspiration is around shedding the shackles of stress and struggle. I have made millions, lost millions and had to start all over again with nothing. My path back to making millions after experiencing the struggle of loss, has inspired me to write this book in order to show people how to secure their financial future through real estate.

The way that I see it is that property is either your biggest cost making you cash poor or your biggest asset making you cash rich. Property Quadrants shows how anyone, no matter where they are starting from, can use property to become cash rich and help others do the same.

Quadrants one and two explain cash poor property, how making an emotional purchase means that you have to pay your mortgage or mortgages out of your wages. Effectively this leads the majority of people to being cash poor and living a life of struggle. That is why 80% of investors only have one investment property.

Quadrants three and four explain cash rich property. Quadrant 2 demonstrates how to work with property to make active income. As well as lump sums of cash to buy the lifestyle you want and get the deposit for investment property.

Quadrant four outlines my formula to buy passive income property. Once you have passive income, you secure your future as you no longer rely on a job and you can pay your family home off quicker and buy those quadrant two properties without draining your pockets.

“How To Be Financially Free In 10 Years Or Less Regardless Of Your Age, Income, Or Experience!”